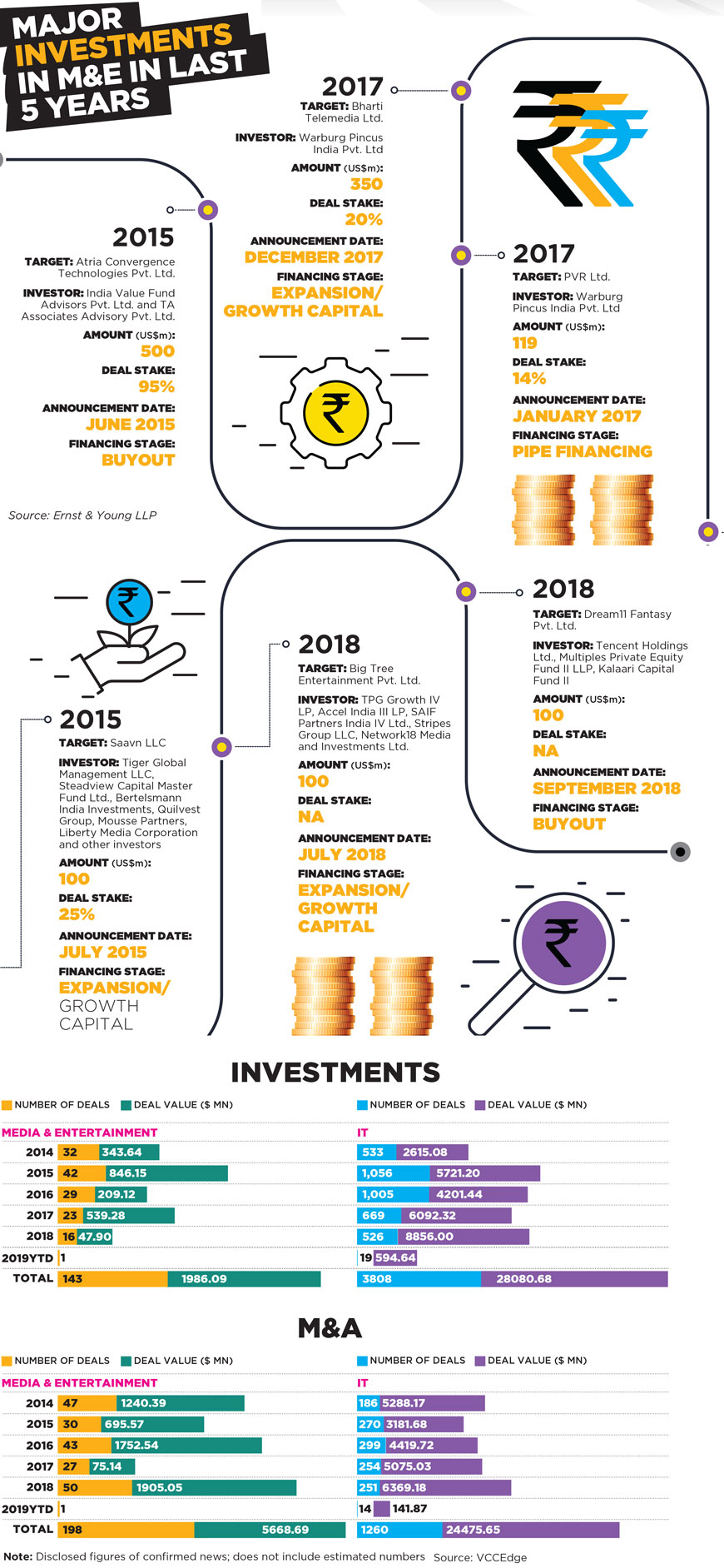

Meanwhile, data from VCCircle for the year 2018 (entire year) says value of investments in the M&E sector barely touched $47.90 million for 16 deals. The mismatch with EY data is because VCCircle figures are only based on deals confirmed and disclosed by the company, and not estimates, whereas EY data includes all the news reports (confirmed/non-confirmed) and estimated numbers too. For example, EY data includes PE investment in Dream 11, which was about $100 million in 2018. But VCCircle has not included it in calculations as those are estimated numbers and the company has not confirmed them.

“What has happened is that the number of transactions in the traditional media space have been fewer. So the large deals of the previous years like Dish TV-Videocon, Warburg-Airtel DTH, or Zee-Ten Sports, etc., have not happened in 2018 - that makes it look small. But today, there is a lot of new deal activity and investor interest in emerging segments like Digital content and Gaming – basically, areas which are straddling both media and technology,” says Koreel Lahiri, Programme Director - South Asia, Media Development Investment Fund. “Further, both media companies and investors are building themselves to take a position of strength in the vernacular market. Investments might seem to be only trickling in right now, but that is really going to be the next phase of powerful growth for Digital media in India,” he adds.

DRAWN TO DIGITAL

The Digital or new-age space is seeing a wave of funding from financial investors, specifically venture capitalists. “Companies such as Pocket Aces, Dream 11, Roposo, etc., are the recent examples of funding by PEs and VCs in the Digital media space. The largest deal in 2018 saw Tencent, Multiples and Kalaari together invest $100 million to buy out Dream 11,” says Ajay Shah, Transactions Partner (M&E), EY.

“Investments in the traditional media space are going down because in most segments, there are well entrenched players. Also private equity investments in Media in the past 10 years have not given very good returns,” says Abneesh Roy, Research Analyst - Senior Vice President - Institutional Equities –Research, Edelweiss Securities Limited.

Another reason why investments in traditional media like publishing, Cable & DTH, Television, etc., have declined is because these are highly capital and infrastructure intensive companies. It takes time to build scale. Indian Media is highly skewed towards advertising revenues. And monetization is completely dominated by players who already have certain scale. Subscription revenues are a tiny portion which do not even support the variable cost. This also gives very little exit opportunity for investors. “Segments that are getting least interest from PE investors are: Print, due to user shift to Digital modes, lack of exit opportunities and limitation of FDI in Print up to 26% and Events, due to unstructured market, lack of infrastructural development and pricing models,” says Girish Menon, Partner and Head, Media & Entertainment, KPMG India.

Money in Digital is much easier to leverage and gather scale compared to Publishing and Television. Also, a lot of investment is being made not on infrastructure but on content. Content does not require huge investments, except for a few big players like Netflix and Amazon Prime, that are spending big on content. Hence the overall average of investments is being dictated simply by the slowly changing nature of the industry.

WHERE THE MONEY IS GOING

The top 70 companies that have raised more than $1 million of funding in the Media & Entertainment industry can be broadly classified into the following four types:

• News portals- e.g., Inc42, YourStory, the Ken, InShorts, etc.

• Song streaming- e.g., Saavan, Gaana, Hungama, etc.

• Video streaming- e.g., TVF, Arre, Dekkho, etc.

• Digital content house- e.g., ScoopWhoop, Factor Daily, Pocket Aces, etc

In addition to these, social media platforms with video content, e.g., Tik Tok, Like, etc,. are gaining popularity among millennials. “Thanks to Internet penetration across Tier II and Tier III cities, the country is witnessing a data revolution. Video social media apps (that are mostly Chinese) are gaining popularity (more than 1M PlayStore downloads). It also indicates that the content choices of Bharat and India are quite distinct,” says Apurva Damani, Managing Director, Artha India Ventures.

Companies like Blumeventures and Kalaari Capital are making their initial bets in Digital content and Digital media. According to an industry source, companies like Times Internet undertake about 20 deals a year on a strategic perspective, but they might not feature in the average league tables of deal-making. So, there is a lot of deal-making that is happening in media, media tech and allied areas which can aid a larger news organization or a larger media organization in aggregating a different set of audience.

CASE FOR CONSOLIDATION

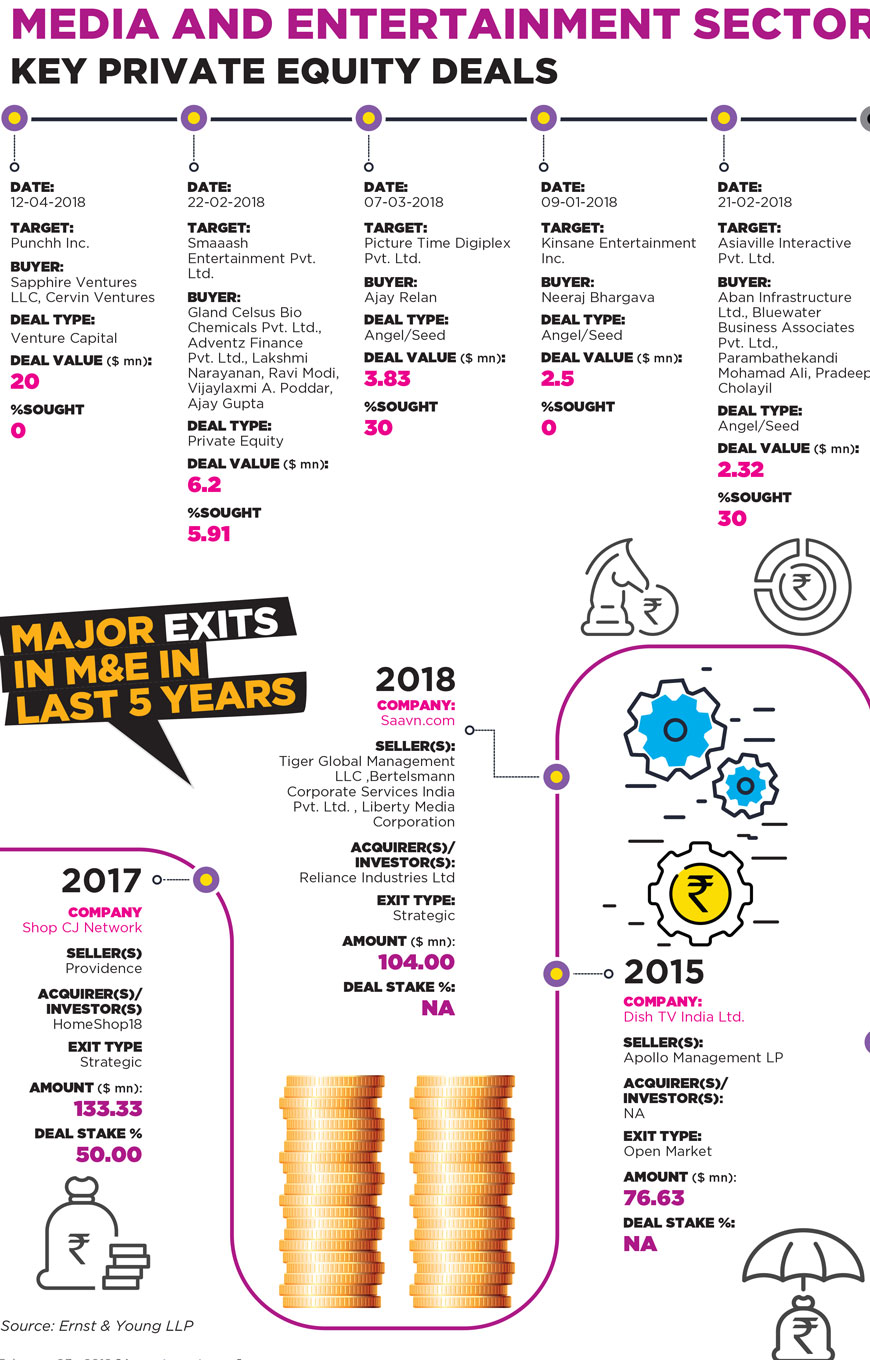

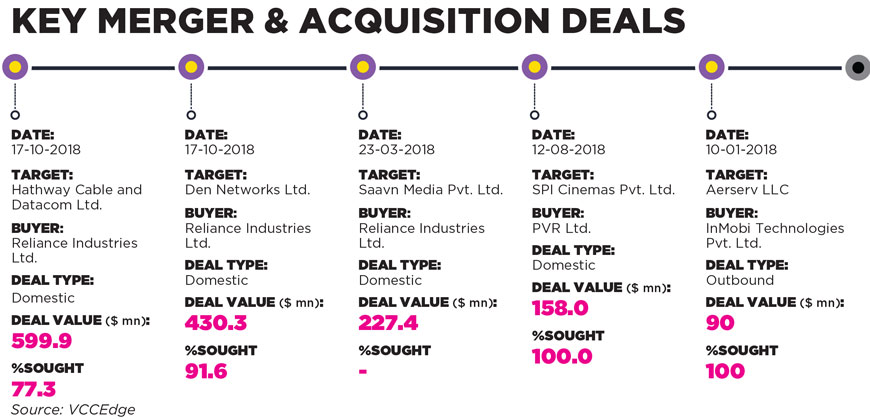

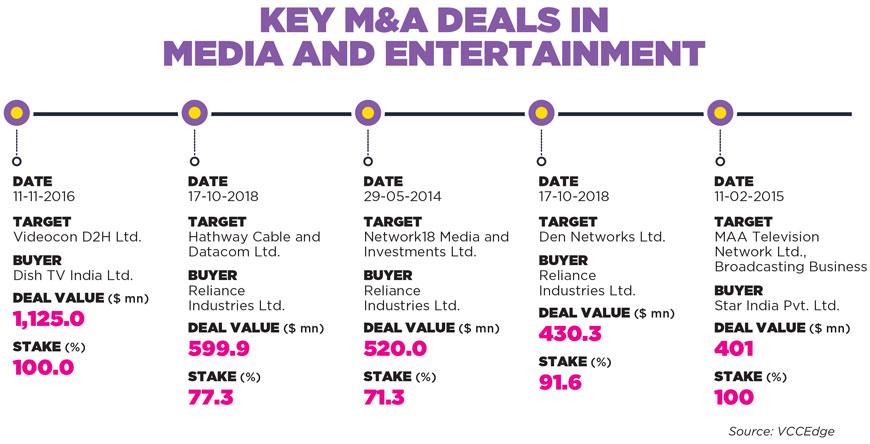

The year 2018 saw around 50 mergers and acquisitions (M&A) amounting to a deal value of $1905.05 million, which is maximum in the last five years. “The Media & Entertainment space is ripe for consolidation and we are seeing the multiplex, Radio, distribution, Broadcast sub-sectors acquiring strong business verticals to expand and complement their existing businesses. We also believe this is a trend likely to continue going forward as large media companies look to further strengthen their positions in this fast-growing sector. The Indian M&E sector is also seeing huge interest from global strategists who want to leverage the India growth story,” says Ajay Shah of EY.

“Multiplexes have been on an inorganic spree especially in Tier II and Tier III cities to capture the market due to decreased capex in such areas, leading to improved returns on investment. Also, on a sector level in India, Media & Entertainment growth to an extent has been driven by telecom convergence during the past two years, with telecom players leading the acquisition spree in content repositories. Whilst traditional spaces like Television distribution and film exhibition should continue to see investor interest through consolidation, animation and VFX are likely to see more investments given the digital consumption drive by OTT players and film producers,” says Girish Menon of KPMG.

CHALLENGES & OPPORTUNITIES

While the explosion of data, analytics and connectivity has dramatically enhanced a Private Equity (PE) firm’s ability to assess a company during the diligence stage, the investors are also looking forward to companies that bet big on technology, irrespective of the segment. How Digital has already affected the profit pool of the company will affect PE firms’ decisions in the next 3-5 years.

However, the key challenge for Indian companies in this space is to develop engaging content and applications that will get them more users that they can retain. “Indian companies are sluggish as they are unaware of the strategies that are required to reach the one million download threshold. Indian companies lack customer understanding and how to use it as an advantage to scale. Their Chinese counterparts seem to have figured the secret sauce of understanding their user base and providing relevant content,” says Damani of Artha India Ventures.

Challenges that PE firms face today in the M&E space are with regard to mismatch in valuation expectations, regulatory hurdles and exit opportunities.

CONTENT IS KING, EVEN FOR INVESTORS

Key challenge for investment in Over the Top (OTT) and User-Generated Content (UGC) space is ROI from the platforms

The smartphone is becoming the primary device for consuming content, and 70-80% of time on smartphone is spent consuming content. By 2025, more than 800 million Indians will spend time watching two hours of content daily on their smartphones. This presents an exciting opportunity to build some large platforms. Two broad models that are emerging today are Over the Top (OTT) and UserGenerated Content (UGC).

WHERE’S THE ROI ON CONTENT?

It is true that content for today is expensive and the Indian consumer is very cost conscious. Also because of the shift that is happening from traditional media to digital media, there is a drop in the amount of cost per million. Even from the subscription standpoint, we have not seen the same kind of uptake as that in developed markets. “Subscription-based OTT platforms are way behind compared to advertisingbased platforms and that is because consumers are not willing to pay for content just yet or there are limited avenues in which they are able to pay, for example credit cards, e-wallets, etc., and that is the key challenge for investment in this space currently,” points out Viral Jani, Senior Vice President at Times Bridge, an investment firm based in Mumbai.

So how will investing firms get their return on investments in this price sensitive Indian media market? “Short to medium term subscriptions cannot be the only form of recovery,” says Timmy Kandhari, Founder & Managing Director, Sapphire Professional Services Pvt Ltd, an M&A and private equity advisory service provider. “Before we consider answers to ROI, one needs to consider the following:

a) some of the key creators of content except Netflix among the online giants are looking to use the content as a congregation tool for their other online businesses to take advantage of. Most of them have a significant amount of funding on marketing to absorb this. Their return metrics are very different.

b) For an entity like Netflix, they have a worldwide audience and are not totally dependent on the Indian subscriber base. Content in other languages with subtitles can be a hit too, i.e., ‘Narcos’.

c) India has a large consumer population and that they are not ready to pay enough for content today does not mean it’s not a potential future and paying market. Therefore, producing Indian content is a certainty. The possible model for India in the short to medium time would be a combination of ad funding as well as subscriptions. Even Netflix is looking and considering the same in the short run,” Kandhari explains.

While the monetization model is clear for OTT, players are still experimenting with pricing models to drive higher adoption. Also, it is a highly fragmented space, and consolidation is imminent. “UGC models continue to rapidly scale user-base, but monetization is still nascent. Once some of the platforms reach critical mass (25-30 million users), we will see monetization models emerging. Ad-based Average Revenues Per User (ARPUs) are very low in India, hence we will see players experimenting with new monetization models like micro-payment, gifting, etc. While having a large user-base is important, equally important is how monetizable is the user-base. For example, a UGC platform with 100 million users and $1 ARPU can generate $100 million in revenue, and so can a UGC platform with 25 million users and $4 ARPU,” says Darshit Vora, Principal - Kalaari Capital. Kalaari has invested in ScoopWhoop, Popxo and Yourstory in the digital media space. They recently invested in Vokal, which is a Q&A-based UGC content platform for vernacular language users. From English content point of view, the Internet has reached a plateau, and vernacular is where major investment will happen in future. “The next wave of growth post Jio and Internet penetration growth is the Indian language content and we will see content platforms and media companies chasing that audience. That’s completely a big thing for the next five years,” says Viral Jani, Senior Vice President, Times Bridge.

“Today, there is a lot of new deal activity and investor interest in emerging segments like Digital content and Gaming – basically, areas which are straddling both media and technology.”

“Today, there is a lot of new deal activity and investor interest in emerging segments like Digital content and Gaming – basically, areas which are straddling both media and technology.”KOREEL LAHIRI

Program Director - South Asia, Media Development Investment Fund

“Segments that are getting least interest from PE investors are Print due to user shift in digital modes, lack of exit opportunities and limitation of FDI in Print up to 26% and Events due to unstructured market, lack of infrastructural development and pricing models.”

“Segments that are getting least interest from PE investors are Print due to user shift in digital modes, lack of exit opportunities and limitation of FDI in Print up to 26% and Events due to unstructured market, lack of infrastructural development and pricing models.” GIRISH MENON

Partner and Head, Media & Entertainment, KPMG India

“We believe this trend of consolidation is likely to continue going forward as large media companies look to further strengthen their positions in this fast-growing sector. The Indian M&E sector is also seeing huge interest from global strategists who want to leverage the India growth story.”

“We believe this trend of consolidation is likely to continue going forward as large media companies look to further strengthen their positions in this fast-growing sector. The Indian M&E sector is also seeing huge interest from global strategists who want to leverage the India growth story.” AJAY SHAH

Transactions Partner (M&E), EY