The chilling funding winter of 2023 produced merely two unicorns in India, compared to a historic 45 just two years back in 2021, and 23 in 2022. While the second one of them, InCred, came from the fintech space which is ubiquitously hailed as ‘promising’, the first one, Zepto, was from quick commerce, a sector that had many naysayers. The minting of this rare Indian unicorn happened when the segment was battling headwinds globally. Outside India, Gopuff and Getir were bleeding cash and pruning their workforce. However, back home, the optimism surrounding Zepto’s rise amidst stiff competition from incumbents like Zomato’s Blinkit, Swiggy Instamart, Reliance-backed Dunzo, and Tata’s BB Now stood out.

By definition, Quick Commerce provides the convenience of the fastest possible doorstep delivery of groceries and other consumables. The $5.5Bn (by 2025) opportunity began as part of India’s e-grocery market, which grew by 80 percent to reach $2.66 billion in 2020. According to Statista, online grocery purchases saw a marked surge during the coronavirus (COVID-19) pandemic in India, with BigBasket which had the highest share among online grocers in 2019 and Grofers which rebranded as Blinkit in 2021, receiving 283000 and 190000 orders respectively on the 28th day of the lockdown, up from 150000 and 100000, pre-lockdown.

There has been no looking back. The frenzy was such that reckoning exponential growth for the sector, the US Department of Agriculture gave a clarion call to US exporters to latch on to the opportunity when India was at the peak of the pandemic in 2021. Foreign and domestic investments began to pour in. Between July and December that year, the newly launched Zepto closed three funding rounds. With an infusion of $100 Mn from Zomato, Grofers entered the unicorn club and introduced 10-minute grocery delivery in 10 cities. Later that year, it rebranded as Blinkit to underline its focus on 10-minute commerce. In 2022, Zomato completed the acquisition of Blinkit’s parent company, Blink Commerce, in a $626 Mn deal.

Launched in August 2020, Swiggy Instamart had already gained a stronghold after closing over 2 million unique transacting users by November 2021. The following month, Swiggy announced that it would further invest USD 700 million in Instamart. Around the same time, Tata-owned Big Basket jumped onto the bandwagon with the launch of its express delivery service BB Now. At the start of 2022, Reliance Retail invested $200 Mn to acquire 25.8% stake in Alphabet Inc.-backed hyperlocal delivery expert Dunzo, which had started making strides in the quick commerce space. According to some media reports, it was recently in talks with e-commerce major Flipkart, for the potential acquisition of Dunzo by the latter.

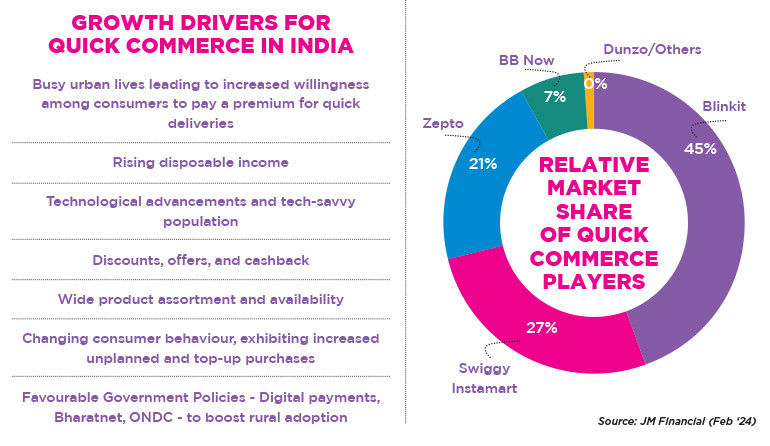

As per global investment firm AllianceBernstein’s report, which termed ‘quick commerce as a 3 player structure in India,’ Blinkit is the market leader with nearly 40% share. Instamart is at 37-39% and Zepto is at around 20% share from a GMV perspective. Various estimates peg 80% of the total market share with these three. However, Statista’s November 2022 report estimates Flipkart as a significant player (Zepto 50%, Blinkit 22%, Flipkart 14%, Others 8% and Swiggy Instamart 6%). The Walmart-backed firm is the leader in the Indian e-commerce market with 48% share. Alongside the potential acquisition of Dunzo, Flipkart is also in the news for planning to launch same-day deliveries in nearly 20 cities in the next few months. With a 14% share already under its belt, this will be the e-commerce major’s second crack at quick commerce after ‘Flipkart Quick’ was scaled down in 2022.

More significantly, last month, Reliance Retail announced that it will roll out instant delivery across 1,000 cities in a phased manner through its e-marketplace, JioMart. As the quick commerce scene heats up, Zomato is set to infuse another round of funds to the tune Rs. 300cr. in Blinkit. With this, the company’s total investment in Blinkit, since it’s acquisition in August 2022, reaches a total of Rs. 2300cr. Brokerage firm Elara Capital pegs Blinkit’s valuation at INR 810bn at INR 92 per share and a 36% contribution to Zomato’s total Enterprise Value (EV).

Meanwhile, quick commerce companies which began with a focus on groceries are fast closing the gap with e-commerce giants as they expand their services to every possible category that one can think of - from beauty and personal care to electronics and stationery to ceiling fans!

THE GROWTH DRIVERS

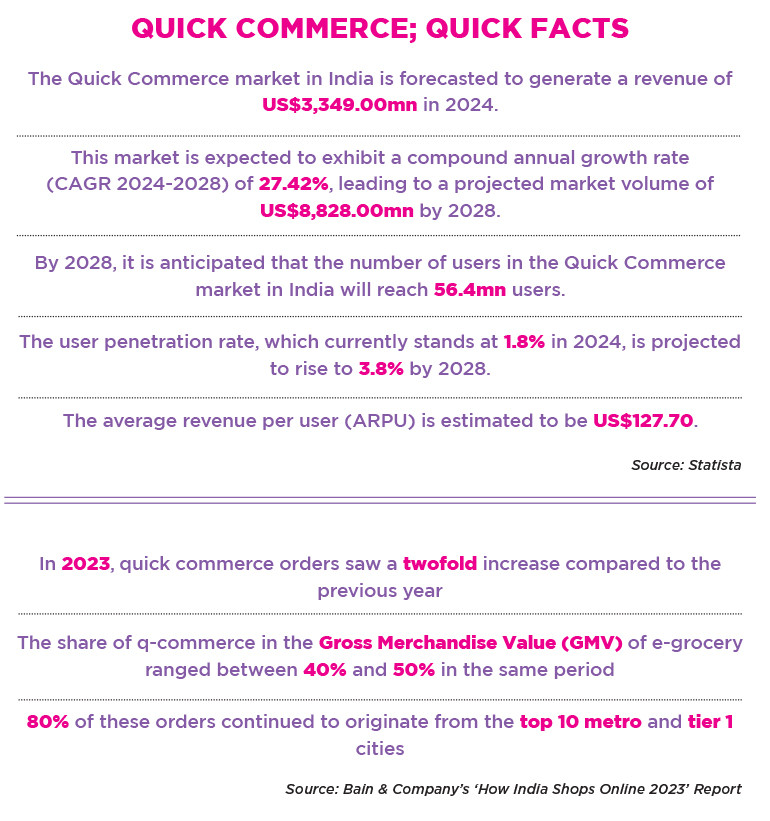

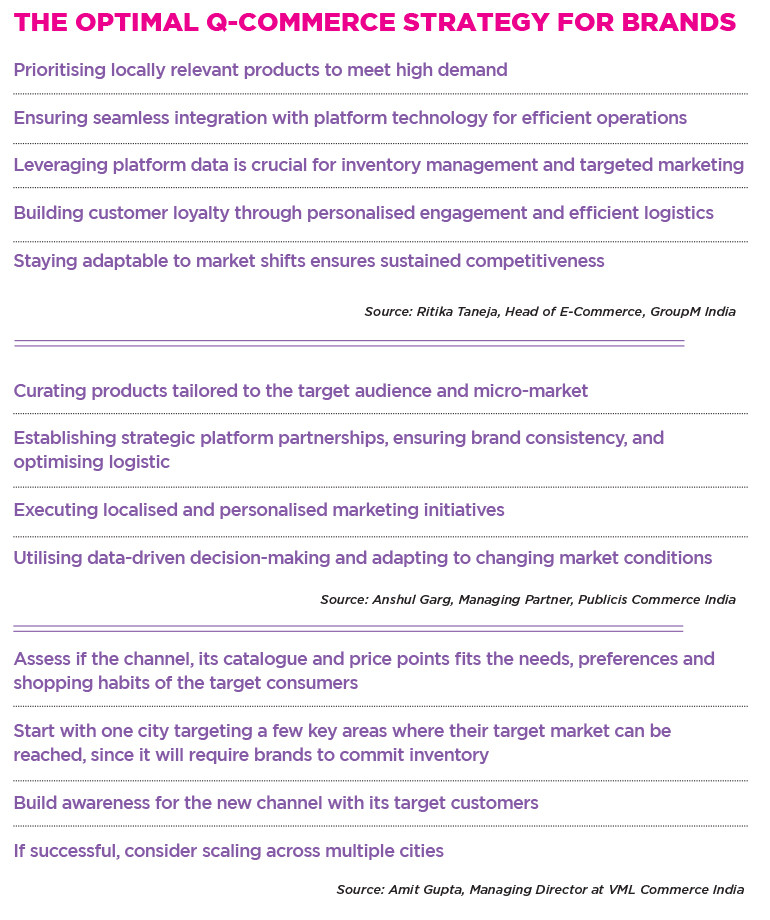

The Quick Commerce market in India is forecasted to generate a revenue of US$3,349.00m in 2024, according to Statista. It is expected to exhibit a compound annual growth rate (CAGR 2024-2028) of 27.42%, leading to a projected market volume of US$8,828.00m by 2028. By the same year, it is anticipated that the number of users in the Quick Commerce market in India will reach 56.4m. The user penetration rate, which currently stands at 1.8% in 2024, is projected to rise to 3.8% by 2028. The average revenue per user (ARPU) is estimated at US$127.70. Commenting on the growth drivers, Anshul Garg, Managing Partner, Publicis Commerce India says, “The convergence of changing consumer behaviour, technological advancements, strategic partnerships, and the adaptability of quick commerce platforms to evolving market demands has fuelled the significant emergence and growth of this model in India. The swift expansion has contributed to the enhancement of unit economics, driven by increased order density, optimization of delivery and warehousing costs, improved Average Order Value (AOV) achieved through the diversification of product assortments beyond groceries, and strategic advertising initiatives.”

Commenting on the growth drivers, Anshul Garg, Managing Partner, Publicis Commerce India says, “The convergence of changing consumer behaviour, technological advancements, strategic partnerships, and the adaptability of quick commerce platforms to evolving market demands has fuelled the significant emergence and growth of this model in India. The swift expansion has contributed to the enhancement of unit economics, driven by increased order density, optimization of delivery and warehousing costs, improved Average Order Value (AOV) achieved through the diversification of product assortments beyond groceries, and strategic advertising initiatives.”

Generally speaking, consumer purchase strategies for grocery are categorised into three types depending on the mode of purchase and the value proposition of these modes. These include ‘stock up’ or bulk purchases for long-term consumption, which happens mainly through supermarkets and local kirana stores; ‘Top-up’ for daily consumables through local kirana stores and online platforms; and ‘Unplanned’ or emergency purchases for daily items through local kirana stores and quick commerce platforms. Recent years have witnessed increasing willingness among consumers to pay a premium for quick deliveries. Shopping habits have tilted towards more frequent unplanned and top-up purchases, particularly in metro and tier I cities, which is facilitating the growth of the quick commerce industry in India. Attributing this growth to the young and tech-savvy consumers, Amit Gupta, Managing Director at VML Commerce India adds, “The rapid growth of India’s quick commerce market can be attributed to the high expectations of modern-day customers. These expectations have been focused on the acceleration of the inspiration-to-conversion journey. Customers are asking for more diversity of choice, simpler payment experience, more discounts and fast delivery within 15 to 20 minutes of purchase.”

Attributing this growth to the young and tech-savvy consumers, Amit Gupta, Managing Director at VML Commerce India adds, “The rapid growth of India’s quick commerce market can be attributed to the high expectations of modern-day customers. These expectations have been focused on the acceleration of the inspiration-to-conversion journey. Customers are asking for more diversity of choice, simpler payment experience, more discounts and fast delivery within 15 to 20 minutes of purchase.”

COMING OF AGE

Implemented during the pandemic, as a practical strategy amid lockdown, q-commerce has affected a lasting shift in consumer behaviour that is no longer limited to just grocery. Today, products from across categories, including non-essentials such as beauty and personal care, electronics and appliances, home and puja items, toys and stationery, are being ordered through these platforms. Lockdowns have long morphed into celebratory and other everyday events. The 10-minute promise may have been diluted to 20, 30 or even 45 minutes in some cases, but the combination of convenience, speed, and service continues to allure online shoppers as a unique proposition.

As Garg further points out, “The introduction of Quick Commerce in India posed a challenge for players, urging users to transact in categories like groceries with lower ticket sizes. The advent of COVID prompted a shift to quick commerce apps due to retail restrictions and convenience, fostering habitual usage. Post-Covid, despite the reopening of traditional retail, a significant shopper base persists in utilising and making purchases through Q-Commerce platforms. As per industry stats, in 2023, quick commerce orders experienced a twofold increase compared to the previous year. The share of q-commerce in the Gross Merchandise Value (GMV) of e-grocery ranged between 40% and 50% in the same period. Notably, 80% of these orders continued to originate from the top ten metro and tier 1 cities.”

Ritika Taneja, Head of E-Commerce, GroupM India says, “Busy urban lives with rising disposable incomes find doorstep delivery within minutes irresistible. Fuelled by fierce competition and billions in investment, quick commerce has transformed from a pandemic hack into a mainstream shopping phenomenon. It’s not only about groceries anymore but also about tapping into a society hungry to get its immediate needs fulfilled, perfectly aligning with a tech-driven, convenience-craving India.”

Ritika Taneja, Head of E-Commerce, GroupM India says, “Busy urban lives with rising disposable incomes find doorstep delivery within minutes irresistible. Fuelled by fierce competition and billions in investment, quick commerce has transformed from a pandemic hack into a mainstream shopping phenomenon. It’s not only about groceries anymore but also about tapping into a society hungry to get its immediate needs fulfilled, perfectly aligning with a tech-driven, convenience-craving India.”

According to Taneja, the transformative shift in product categories reflects a response to consumers’ time constraints and desire for convenience. While commenting on the evolution of purchase behaviours on quick commerce apps, she notes, “Through strategic partnerships and localised inventory management, q-commerce apps have been able to tailor their offerings to match regional demands, including seasonal goods and local specialities. This personalised approach not only enhances customer satisfaction but also cultivates loyalty.”

MARKETERS EMBRACE SPEED Recognising the growing significance of quick commerce in today’s fast-paced consumer landscape, brands across categories are stepping up their efforts on these platforms. As an upcoming channel for distribution, quick commerce is growing at a faster pace than traditional e-commerce. In an earlier interaction, Ritesh Arora, CEO, India Business & Far East, LT Foods Ltd told IMPACT that the “revenue contribution from e-commerce (traditional e-commerce + quick commerce) stands at approximately 9 to 10%. Of this, quick commerce accounts for about 4-5%, making the remarkable growth trajectory of quick commerce within its specific category worth mentioning.”

Recognising the growing significance of quick commerce in today’s fast-paced consumer landscape, brands across categories are stepping up their efforts on these platforms. As an upcoming channel for distribution, quick commerce is growing at a faster pace than traditional e-commerce. In an earlier interaction, Ritesh Arora, CEO, India Business & Far East, LT Foods Ltd told IMPACT that the “revenue contribution from e-commerce (traditional e-commerce + quick commerce) stands at approximately 9 to 10%. Of this, quick commerce accounts for about 4-5%, making the remarkable growth trajectory of quick commerce within its specific category worth mentioning.”

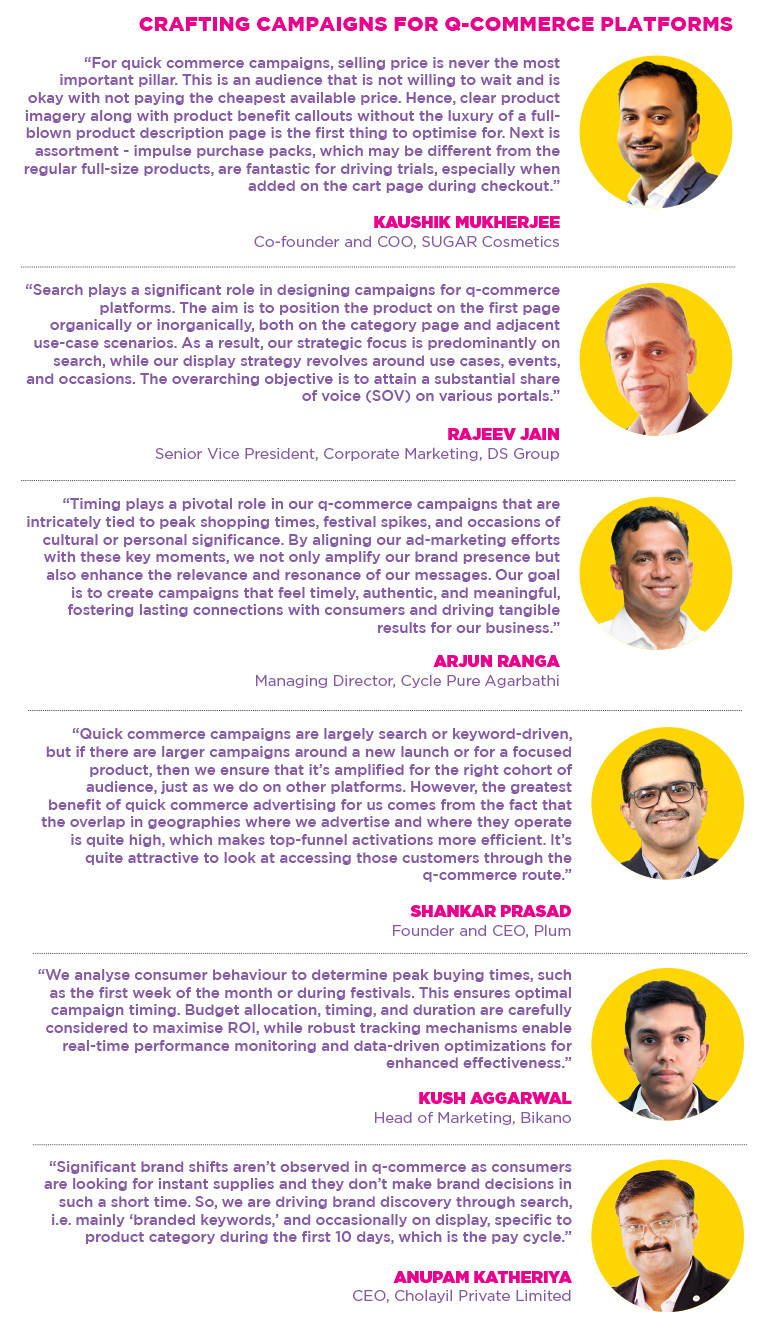

Vegan beauty brand Plum, which started its quick commerce journey almost two years ago, has been scaling along with these platforms, shares, Shankar Prasad, Founder and CEO, Plum. He agrees that leaving out some specialist domains, quick commerce as a vertical is growing faster than average e-commerce. “Our investment as a percentage of revenue is therefore proportional to this growth, just as it is for any other vertical or horizontal marketplace. While the percentage or the spends-to-sales ratio is the same, the actual amount of money that we have been investing in quick commerce for growth is higher because the revenue is growing faster than the e-commerce average,” Prasad explains.

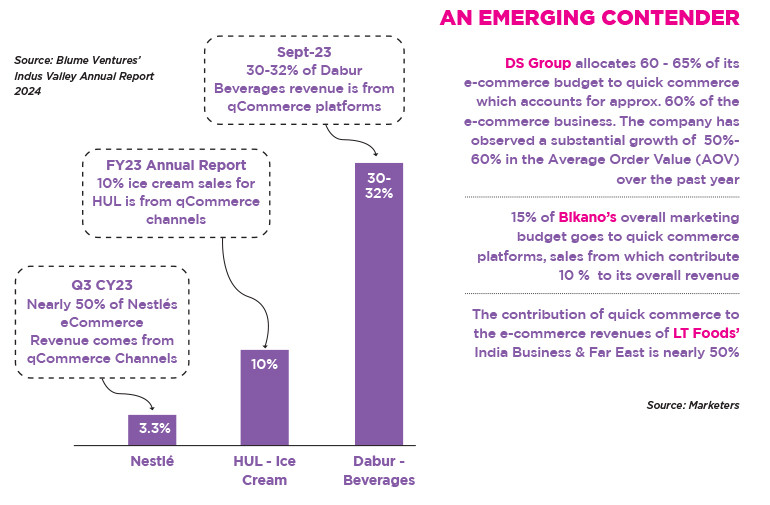

For FMCG major DS Group, quick commerce has proven to be a significant channel for distribution across various product categories, with salt, spices and confectionery emerging as the most popular ones. The brand has strategically partnered with major players such as Blinkit, Zepto, Swiggy, Big Basket, and others to ensure its presence across all national distribution centres, with a prominent focus on Tier I and Tier II cities. Rajeev Jain, Senior Vice President, Corporate Marketing, DS Group shares, “The contribution of these collaborations has been significant, accounting for almost 60% of the e-commerce business. We have also observed a substantial growth of 50%-60% in the average order value (AOV) over the past year. We remain committed to further expanding our presence in the q-commerce space. This involves continued collaboration with all partners, exploring new tech platforms, and strategising to meet evolving customer expectations.”

In addition to the polarisation across metros, Anupam Katheriya, CEO, Cholayil Private Limited has also observed distinct leaders in each market. His investment strategy is therefore designed depending on the market and brand fitment. While commenting on the channel’s potential, he says, “Q-commerce, by design, is driven by consumer behaviours focused on ‘top-up’ and ‘instant gratification.’ Consequently, portion sizes are smaller, aligning with the trend of catering to consumers seeking quick delivery—a necessity in today’s fast-paced environment. At present, Q-commerce is evolving to the next level of growth by incorporating a discounting strategy, akin to e-commerce and traditional retail formats. This shift involves offering a larger assortment to enhance consumer convenience and provide better value. We view this as a significant growth opportunity, and anticipate a shift in consumer behaviour towards planned purchases through Q-commerce.”

Leading snacks brand Bikano is actively expanding its presence on quick commerce platforms, ensuring its products are readily accessible to consumers nationwide. Kush Aggarwal, Head of Marketing, Bikano tells us about the consistent interest in Bikano’s range of savoury snacks and namkeens across various buying occasions. “These products are mostly popular during festive seasons, family gatherings, social events, and as everyday snacks for individuals of all ages. Aloo Bhujia, Bikaneri Bhujia, Natkhat Nimbu, Magic Bhujia, Navratan Mixture, and Tangy Tomato are among the most sought-after products. Moreover, we’ve seen a positive growth trend in the AOV over time. While we cannot disclose exact numbers, sales from quick commerce platforms contribute around 10% to our overall revenue stream.”

As a business dealing in daily puja essentials used by millions of consumers in the country, Cycle Pure Agarbathi looks at quick commerce not only as an avenue for sales but also as a strategic platform for brand visibility and customer acquisition. Arjun Ranga, Managing Director, Cycle Pure Agarbathi says, “As a category of daily essentials, our products experience consistent demand on a day-to-day basis. However, during festivals and special occasions, we observe a significant surge in demand, often reaching levels two or three times higher than usual. Therefore, the integration of Q-commerce into our model has undoubtedly proven advantageous. The ability to swiftly deliver our products to our customers ensures that their spiritual needs are met promptly, aligning perfectly with our commitment to customer satisfaction. As we increase the number of products listed on these platforms, we will continue to increase our marketing spends and activities there.”

TAKEN BY SURPRISE

While the success of quick commerce with essentials may have been expected, the ease and enthusiasm with which consumers have embraced ‘non-essentials’ on these platforms is rather astonishing. Confessing his unpreparedness, Kaushik Mukherjee, Co-founder and COO, SUGAR Cosmetics says, “To be honest, quick-commerce was never a part of our original business plan for financial year 2023-24. However, over the last six months, its surge has taken a lot of brands, including us, by surprise. There is a clear need for last-minute shopping even in the beauty and personal care segment, and we’ve seen strong traction in categories like eye makeup and sheet masks.”

Mukherjee believes that quick commerce has opened up a whole new audience segment and shopping use case for brands like them. “Historically, beauty has always been a very involved purchase with heavy dependence on product education and trials. Quick commerce proves that sometimes customers know what they want and are not looking to window-shop. This is especially true in replenishment purchases where the customer is an existing product user and is just looking to make a purchase after she has finished using her existing unit. In such cases, speed of delivery matters – sometimes, even more than price and discounts. This makes quick commerce especially attractive to brands like ours, who do not believe that discounting is a long-term growth strategy for a brand.”

THE BIG OPPORTUNITY FOR ADVERTISING

A two-way street for quick commerce brands, advertising is set to reap the benefits as these speed delivery platforms transform the country’s retail landscape. While 2023 may have been a tough year for startups, according to media reports, quick commerce as a segment contributed 20-25% of all IPL ad spends, somewhere in the range of INR 700-750 Cr. in the previous year (2022). Currently positioned in the early growth stage, these businesses will continue to address their advertising and promotional needs even if not through means as ostentatious. As they fend off the challenges of 10-minute commerce stemming from infrastructural/logistical needs, discounts and smaller order value, innovation and automation of supply chains, alongside growing advertising revenues could be their key to sustainable growth.

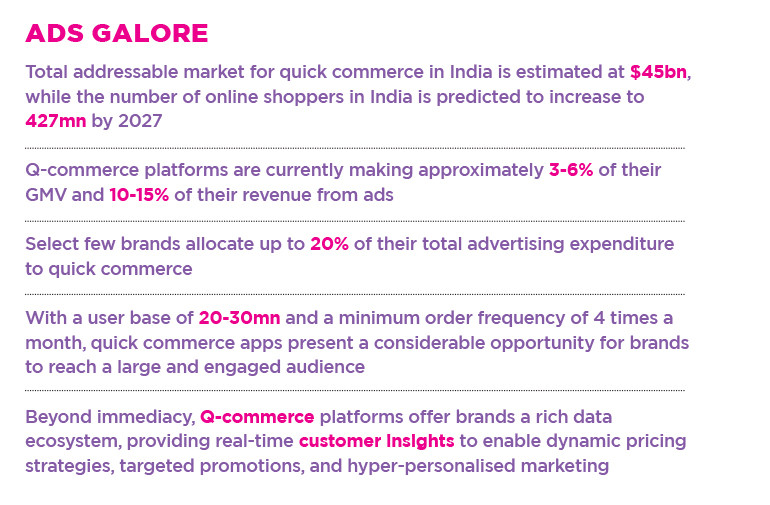

According to Blume Ventures’ Indus Valley Annual Report 2024, Q-commerce platforms are seeing 3-6% of their GMV and 10-15% of their revenue coming from ads. The report further states, “Given how high margin this is (at least 90% gross margins), it is clearly driving a good chunk of the bottom line”.

Zomato’s quick commerce arm Blinkit for instance, registered 220% YoY growth in advertising revenue in Q3 of FY24. The number of advertisers on the platform surged to 557 in Q3 from 242 in the same period a year ago – a 130% increase.

According to Publicis Commerce’s Garg, “At an overall level, quick commerce apps may have a single-digit market share within the broader landscape of digital advertising. It is noteworthy that a select few brands allocate up to 20% of their total advertising expenditure to quick commerce.”

Among the brands we spoke to, DS Group allocates 60 - 65% of its e-commerce budget to ensure a strong online presence for its quick-commerce offerings. For Bikano, the figure stands at 15% of its overall marketing budget. While spends on Q-commerce are a limited percentage of SUGAR’s overall marketing investments, buoyed by the progress of the category on these platforms, the brand has factored in stronger budgets to scale the business faster in the upcoming fiscal.

The total addressable market for quick commerce in India is estimated at $45 billion. With a population of more than 1.4 billion and a fast-growing economy, the number of online shoppers in India is predicted to increase to 427 Mn by 2027. Q-commerce apps are already capturing a sizable portion of the online grocery market, with a 13% market share, and are preferred by 46% of consumers for online grocery shopping. Leading players like Zepto, Blinkit, and Swiggy Instamart dominate hyper-local mobile marketing strategies, leveraging geo-targeting, push notifications, and in-app ads to engage users effectively.

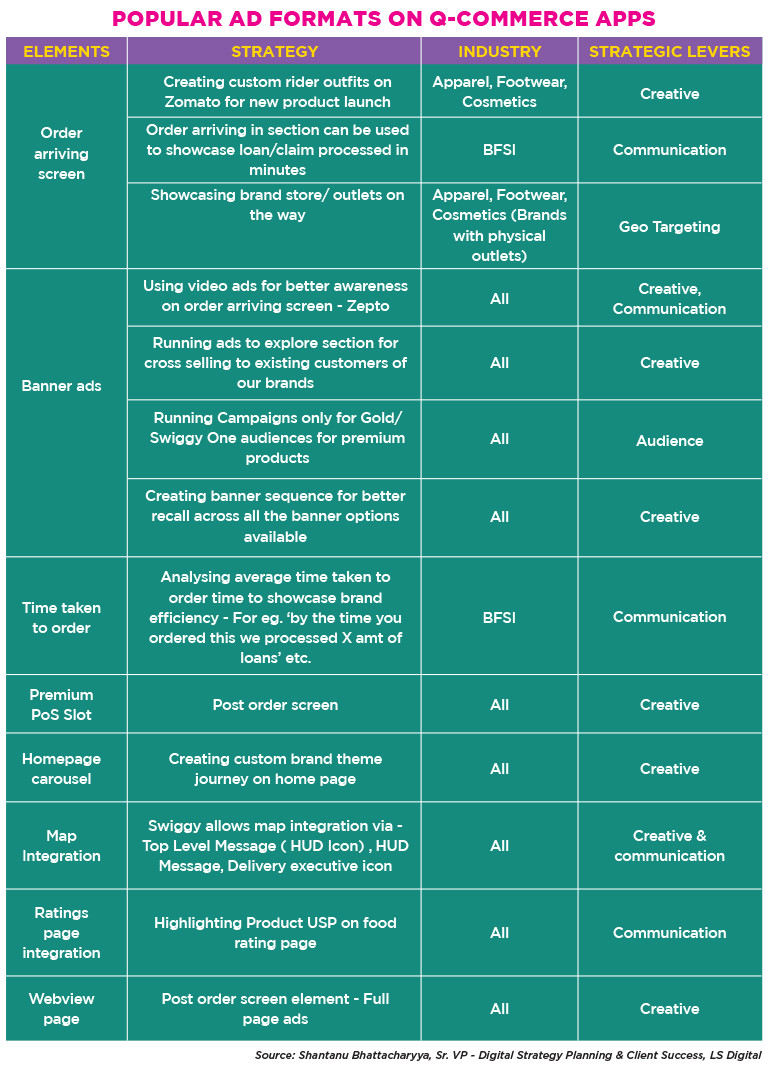

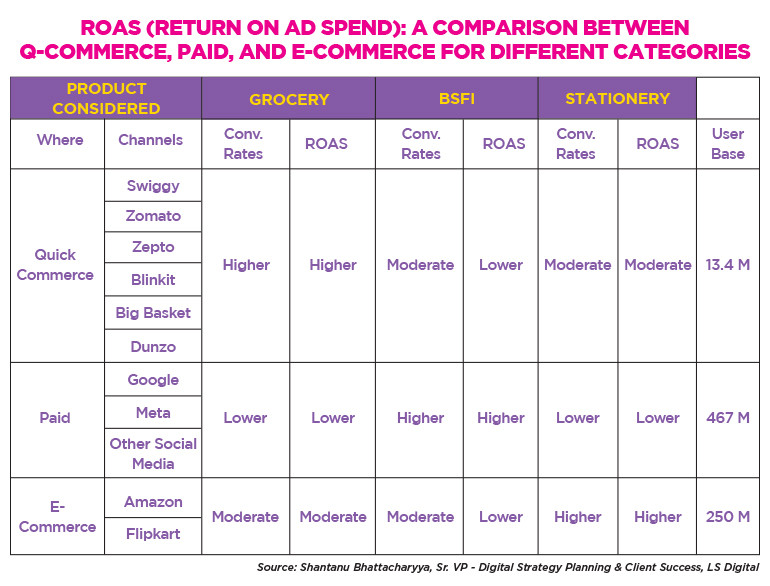

Commenting on the possibilities, VML Commerce India’s Amit Gupta states, “Quick commerce is gaining a significant share of online advertising in India. It has a user base of 20-30 million and a minimum order frequency of 4 times a month. This presents a considerable opportunity for brands to reach a large and engaged audience.” Shantanu Bhattacharyya, Sr. VP - Digital Strategy Planning & Client Success, LS Digital believes that with Q-Commerce gaining consumer traction in India, brands would find it increasingly beneficial to reach-out to an upwardly mobile audience strapped for time. “However, they need to evaluate the fit with the audience profile and its relevance to the consumer while using a particular platform. The real test for Q-Commerce platforms would be to develop advertising inventory that delivers value to the advertiser while being non-intrusive to their consumers,” he observes.

Shantanu Bhattacharyya, Sr. VP - Digital Strategy Planning & Client Success, LS Digital believes that with Q-Commerce gaining consumer traction in India, brands would find it increasingly beneficial to reach-out to an upwardly mobile audience strapped for time. “However, they need to evaluate the fit with the audience profile and its relevance to the consumer while using a particular platform. The real test for Q-Commerce platforms would be to develop advertising inventory that delivers value to the advertiser while being non-intrusive to their consumers,” he observes.

“Beyond immediacy, Q-commerce platforms offer brands a rich data ecosystem, providing real-time customer insights to enable dynamic pricing strategies, targeted promotions, and hyper-personalised marketing. Additionally, these platforms serve as expanded distribution channels, reaching new customer segments. Smaller brands previously limited by traditional retail infrastructure can now achieve national reach. Maximising q-commerce returns necessitates tactical adaptation, involving curating hyper-local product assortments, crafting targeted promotions, and effectively penetrating Tier II cities via extensive delivery networks,” adds Group M’s Ritika Taneja.

Experiencing substantial growth over the last three years, quick commerce has emerged as a major revenue driver for businesses, thereby commanding proportionate investments from them. Experts reckon that owing to increased customer adoption/ penetration, opening up to multiple categories, and innovative means of digital advertising, the growth of advertising on e-commerce could continue to outpace other segments of digital advertising. Hopes are therefore high from quick commerce, which might be a subset of e-commerce today, but is essentially just the next evolution of it.