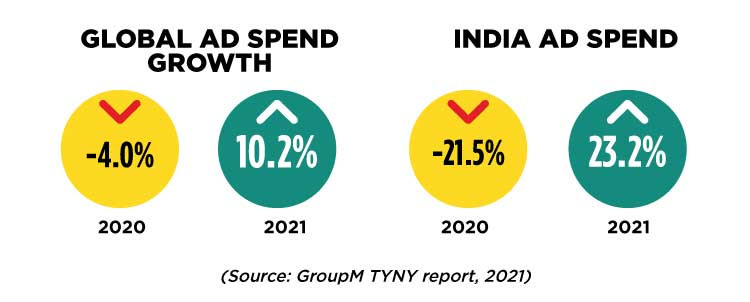

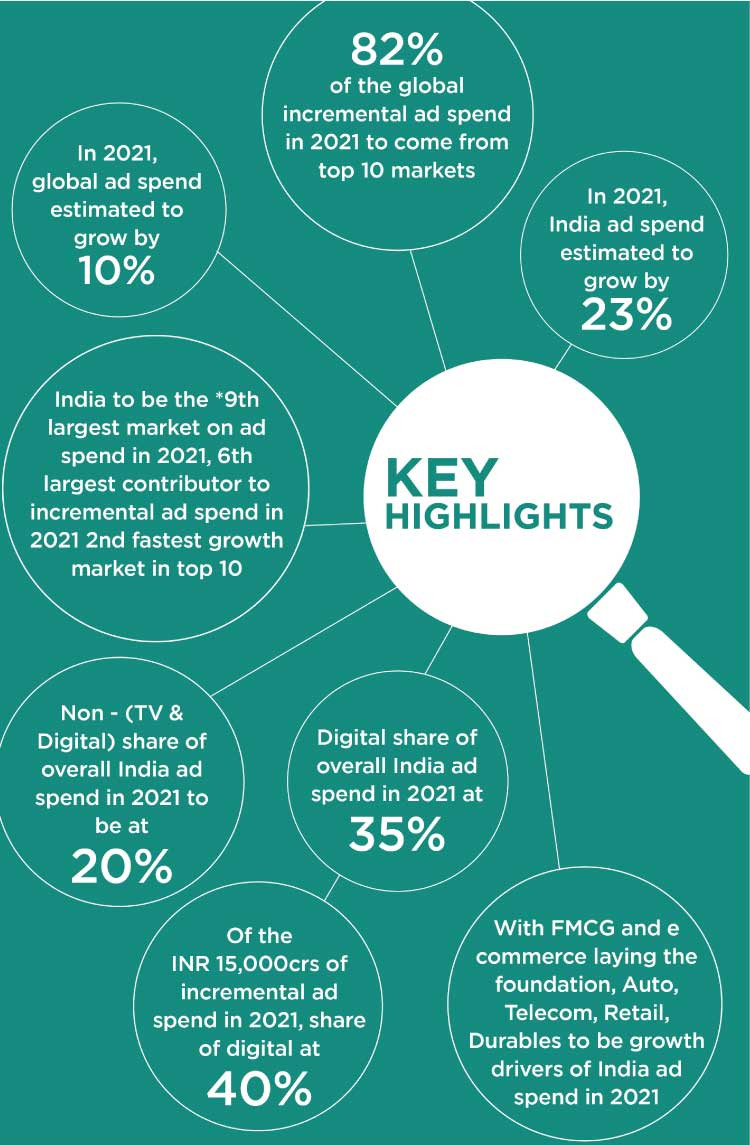

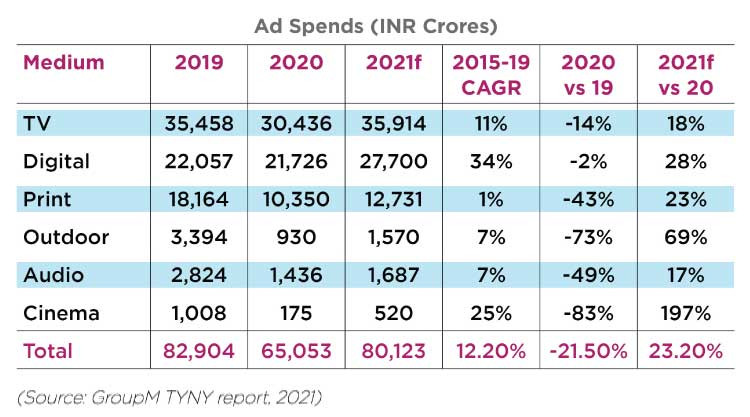

After a year of tremendous upheaval post the coronavirus pandemic, things are looking better and brighter for the media and advertising industry. Terming the industry’s recovery post the lockdown last year as a ‘fantastic phenomenon’, Prasanth Kumar, GroupM South Asia CEO is clear that there is high potential for the industry that is enriched with diverse audiences and tastes. Kumar backs his optimism and his faith in India’s resilience with the findings from the recently launched GroupM report – This Year, Next Year (TYNY), 2021. After a 21.5% decline in ad spends in 2020 due to the pandemic, the Indian ad industry is expected to see recovery in 2021 with ad investments expected to reach Rs 80,123 crore, which is a 23.2% growth over 2020 and 3.35% growth over 2019 ad expenditure of Rs 82,904 crore. The report names India as the second fastest growing market in the top 10 countries and predicts that it will be the sixth largest contributor to incremental ad spends in 2021 globally.

A DIGITAL-LED RECOVERY FOR 2021

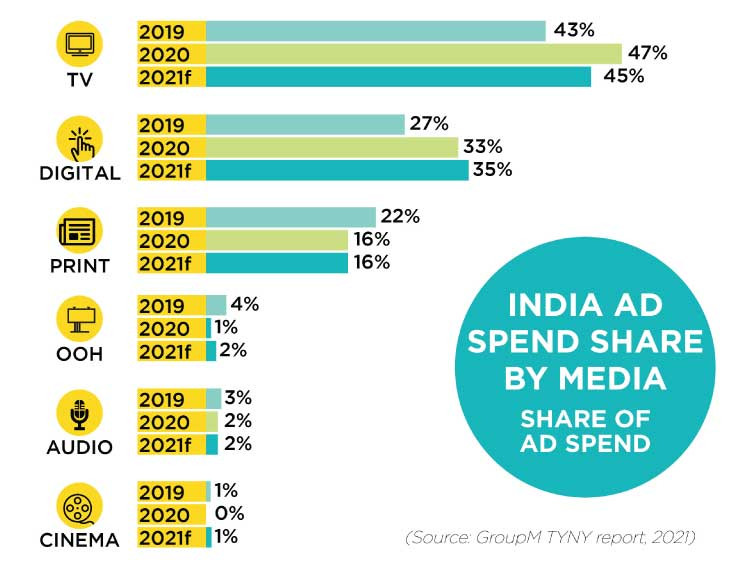

Of the Rs 15,000 crore of incremental ad spends in 2021, the share of Digital is at 40%, says the report. The digital share of overall India ad spends in 2021 will be at 35%. The report expects FMCG, e-commerce, auto, telecom, retail, and durables to be growth drivers of ad spends in 2021. Digital was the only medium to witness a gain of $27 billion globally in 2020. Digital as a media vehicle will continue to climb sharply due to the increase in digital dependency and changing consumer patterns, the report said. Speaking of the powerful growth trajectory displayed by Digital, Kumar explains, “It is a medium through which we can interact and exchange information. From consumption, transaction and commerce, everything will get digitised. Even from a connected TV perspective, there is content happening and the device is enhancing connected TV penetration.”

Further the report also adds that Television is estimated to grow by 18% and will continue holding its dominant share of ad spends in India. Along with the overall increase in demand, TV would also register incremental ad spends with four state elections and additional major sporting events in the year. Some of the categories likely to help drive growth on TV are auto, e-commerce and telecom. Print will also begin slow and grow progressively much like other media in 2021. Overall, the medium is estimated to grow by 23% in 2021 over 2020.

The report also shares some of the top trends that will shape the industry in the coming years. The trends presented were around consumer behaviour, sports, gaming and e-sports, growth of OTT, connected commerce, the ecosystem of fragmented social media, digital transformation, innovations in audio, etc. Kumar notes that despite the 23% growth projection for 2021, India is still lower than the 2019 AdEx. Nonetheless he adds that the industry is well on its way to recovery. “The ad industry too had its challenges and 2020 witnessed a steep drop in the overall media investments. However, we have witnessed a month-on-month upturn in the industry starting Q3 last year and we are quite optimistic about the revival that 2021 will see. With the gradual easement of the lockdown backed by seasonal spends and big-ticket events like IPL, we expect 2021 to continue to build on that momentum,” he observes. The biggest takeaway was of the industry’s resilience as seen with both consumers and brands. As Kumar puts it, “This is a connected world and it is extremely critical. We work for our clients, partners. All of them came together and stayed in touch because we were all facing the same disruption.”

‘FANTASTIC TO SEE INDUSTRY’S GROWTH IN Q4 FROM DECLINE IN Q2’

Q] The GroupM report This Year Next Year has predicted the AdEx will grow at 23%. Many experts have argued that this is quite an optimistic figure. How do you explain it?

If you check the numbers that we have shown, we are still a tad lower than our 2019 level. When we looked at the numbers of the last 10 years, in 2010, we had a growth of over 20%. After that, we haven’t seen that kind of growth. Unfortunately, 2020 was a challenging year with the steepest decline. We are playing on the low base of 2020.

We feel that the lowest decline – close to 60% -- seen last year in Q2 is also helping us see a larger growth. Globally, the 10% growth is being seen as a 6% growth over the 2019 AdEx. But in India at 23% growth, we are still lower than 2019 AdEx. This is just another perspective to look at it. From quarter to quarter, we are looking at

different categories and sectors contributing to it and the different mediums playing on.

Print has witnessed the deepest impact in value followed by TV, Outdoor & Cinema. While Digital least impacted

Q] 2020 saw disruption in measurement. While digital measurement was always a concern, even print and one genre of TV saw a lack of clarity on measurement during the pandemic year for different reasons. How did this impact AdEx in 2020? How are you dealing with clients on this front?

The measurement perspective is one of the aspects that have been playing on for multiple years now. But in 2020, we saw how it played out for each medium from a different perspective. From a digital point of view, it accelerated opportunities for consumption. Multiple mediums also had availability issues and the aspects that were playing on from the month of March-end 2020.

We also saw how it played on from a TV perspective at that time because content productions had their aspects. But from a measurement perspective, it is another aspect that has challenges but has been an issue for many years. It is a vital problem its solution will only add an opportunity to that particular medium.

With our clients, we are looking at three pillars. Firstly, if the ecosystem can share the authenticity of certain working models, which could be a surrogate measurement from a digital or engagement perspective on certain campaigns.

Secondly, from a brand’s perspective, for every campaign, there is a certain understanding of an activity that either helps brands or achieves expected results. Thirdly, understanding different roles with some of the insights is important.

Talking of print publications, the negative impact has been quite high on the English genre. But this is also because they have a heavy dependency on metros. And we all know how the metro consumption fared. This trend has played on to the niche newspaper perspective. There has been a 23% estimated growth in print. But playing on different content and different kinds of solutions will help strengthen the 16% share of print in 2021.

Last year saw a lot of digital media consumption. That is why today organisations and companies are embracing data-related platforms as well as gathering data which helps us get insights into different campaigns. Some data platforms help brands understand the insights of consumers and how campaigns bring in digital difference or the outcome brands are looking for. One, we need to look at a syndicated measurement perspective, and two, look at how each campaign is playing on to it. After a very digitally centric year, we are not in a poor state but in a progressive stage right now. We are getting more data about the consumers and understanding how each campaign is performing in each area.

The more companies start using their sales data, linking on to different platforms, the more it will help enrich the way we can invest our media expenditure into the market.

Q] How did the pandemic change the way your agency functions?

Nobody expected the pandemic to be in this form. While we have been operating from home, not everyone is used to this new working style. We were lucky that our technology and IT teams helped us set off much faster and smoother with tools and technology. Fortunately, we were prepared from the beginning of March itself.

We can live with having flexibility in the way we work. In our line of creative work, it is necessary to catch up but not necessarily be in office.

Technology has proved itself to be of great use in connecting with clients and partners. If we use these tools wisely and systematically, it can turn out to be a big advantage for us. There will be a better turnaround time, allowing us to provide real-time solutions and strategies. When such a drastic disruption comes in, experimenting and adapting to make things move faster has a bigger value.

We all had some learnings, experimenting and correcting things at every point. Mostly, we were successful and sometimes we had to learn from failures. But it helped us grow stronger as a team.

Q] What is your view on the overall digital growth? What consumer behaviour patterns are you noticing?

In 2021, it is about 28% digital growth, which is about 40% growth to incremental AdEx from a digital perspective. It’s interesting that the world is now digital. It is a medium through which we can interact and exchange information. Digital will bring in multiple utilities. From consumption, transaction and commerce, everything will get digitised.

Even from a connected TV perspective, there is content happening and the device is enhancing connected TV penetration. With this, different content and reasons for people to consume, transact or exchange become a key priority.

Q] In the wake of this pandemic, how do you see the value of the Indian media industry being impacted?

There is a high potential for the Indian media industry. It should be rejoicing about the diversity of opportunities. There are new opportunities and new media. There is an audience – both urban and rural -- that is ready to consume. The industry market is enriched with diverse audiences and tastes, which is a great opportunity that the media industry should be cognizant of. There is uniqueness and collective strength which can come out of different networks and groups. This is where the application can be stronger and get into the growth rate mind set always.

Q] Where do you place India on a resilient scale globally during the pandemic?

In the Indian context, especially last year, we had a strict lockdown across the country that brought in multiple challenges. After that, month on month, slowly bouncing back was a fantastic phenomenon. It required a lot of boldness, courage and leap of faith to be adaptive to a newer way of living life. From the decline we saw in Q2, it was fantastic to see the momentum of growth in Q4. We as a collective industry fared very well.

Q] Will 2021 see more media pitches?

There were pitches in the market in 2020. It is also important that at any point in time when the pitch is happening, there is a purpose and objectivity. This value will continue as a practice. 2020 also posed the challenge of knowing the market and the ground level status. Some of the media pitches were deferred to 2021 and some did not. The learning in this is brands can see how they can prepare for the next few years and how their partners can be more prepared to help them. Therefore in 2021, I’m sure it is going to be normal as things have been pre-COVID.

Q] How did your relationship with your clients change during the pandemic?

These are times when people need to be together. Because the disruptions were for both. So clients were hand in hand with us and were very supportive. There are times when they needed us more than they knew, so it was important for us to go one step further. There have been instances in lockdown when we managed campaigns speculating about how different media would behave. At this time, we as a team went beyond our organisation and figured out what was happening in different markets through our relatives. Thereafter, we went to the client, presented those results, interacted with their sales professionals, understood how the market is, and applied the insights to our campaigns. The other aspect is how the clients helped the people focus on mental wellness by motivating our people for all the efforts taken. This is a connected world and it is extremely critical. We work for our clients, partners. All of them came together and stayed in touch because we were all facing the same disruption.

Q] When do you see the luxury brands market recovering?

Each of these sectors will start applying their learnings and looking at sub-sectors, innovative products, categories, etc. to be on the recovery path, slowly making it attractive to different sectors of audiences and targeting the audiences in a unique form. Slowly, it will start picking up. There is momentum but it is nowhere where it used to be. Starting Q2 slowly, we can expect some.

Q] Final thoughts on the recovery of India and global markets

While the growth rates are quite high in 2021, there is a 10% growth globally that we have estimated. In India, we are estimating 23%. India is still -3% over 90% even though it is 23%. We have still not crossed 2019 levels, which has been crossed globally. While we are the second-fastest-growing market, we still have more catch-up to do.