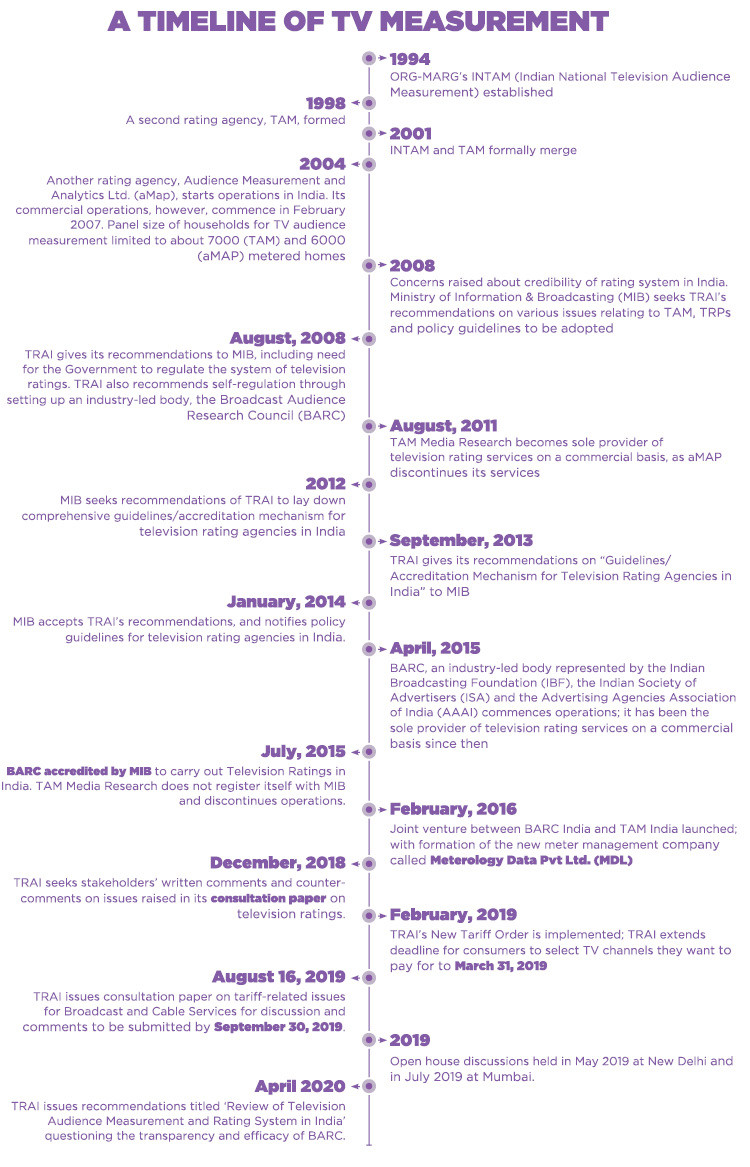

The Telecom Regulatory Authority of India (TRAI)’s recommendations document ‘Review of television audience measurement and rating system in India’ issued on April 28, 2020 is only the latest in a series of attempts to meddle with the broadcast audience measurement system, starting with its March 2008 consultation paper on the subject.

The draft that emerged from that first consultation paper recommended audience measurement by an industry-led body called Broadcast Audience Research Council (BARC). Funnily enough, that was after the industry had made a move in that direction and already signed a Memorandum of Association to set up an audience measurement body by exactly that name.

In doing so, though, it said, “The Authority recommends self–regulation through the industry-led body, with Government exercising oversight through its nominees in the industry-led body…” And went on, quite hilariously, to say that one of the objectives self-regulation should be to “Observe and enforce the conditions/standards/norms prescribed by the Government…”

BARC unequivocally rejected Government involvement, saying self-regulation and Government intervention were a contradiction in terms, and has successfully kept its independence until now.

In the past, TRAI as well as the I&B Ministry tried to justify their intervention by linking audience measurement to TV content and raising the bogey of the socio-cultural effect of prurient content, which they seemed to think was its inevitable consequence. In its latest recommendations, TRAI recognizes audience measurement for what it is: “A major impetus for audience measurement is advertising. It directly impacts the channel-wise direction of advertising expenditures.” If that is all audience measurement is about, why does the TRAI persist in meddling with it?

THE ROLE OF THE ISA

One issue on which I do concur with TRAI – though I don’t believe it is any business of theirs – is on the question of the ownership structure. My concern as an industry observer, and one who has been deeply involved with the subject, is that this measurement system is controlled by those who are being measured.

BARC was originally intended to be an equal-stakes venture of three industry bodies – of broadcasters, the Indian Broadcasting Foundation (IBF), advertisers, the Indian Society of Advertisers (ISA) and advertising/media agencies, the Advertising Agencies Association of India (AAAI). In early 2010, the IBF and ISA got together and threw AAAI out. They soon found that between them, they didn’t have the expertise to set up an audience measurement system, so invited AAAI back in, but not as an equal partner. BARC was finally set up with broadcasters owning 60%, and the other two only 20% each. In effect, those whose performance is being measured hold sway: they don’t need the support of the others to do pretty much anything. BARC was set up because the industry decided it didn’t want a vendor-driven system. It has traded that for a broadcaster-driven system. That is great for the broadcasters, but it has amazed me all these years that the ISA as the body of advertisers, whose money the whole thing is about, has accepted it.

In its Sept 2013 ‘Guidelines/Accreditation Mechanism for Television Rating Agencies in India’, TRAI stipulated that a ratings supplier could not have more than 10% of its equity held by an advertising agency, advertiser or broadcaster. By that requirement alone, the earlier television audience measurement company TAM Media Research, as a WPP Group company, was ineligible. (The present document says, rather ingenuously, “TAM Media Research did not register itself with MIB and discontinued its operations,” omitting to mention why TAM could not have registered.)

Having stipulated a qualifying condition to deal with potential conflict of interest, TRAI went on to register a vendor owned only by the very three categories that condition was meant to restrict. Worse, that vendor was majority-owned by the one category that should not have had the majority. Technically, of course, the three owners of BARC are not broadcasters, advertisers or advertising agencies, but as industry bodies of the three they are owned and run by them. That is no different from Kantar and Nielsen, the two owners of TAM.

ISA, in its wisdom, accepted this ownership structure, and then seems to have quietly gone along with everything that followed.

In 2015, when BARC was just about to get going, broadcasters suddenly stopped subscribing to TAM and advertisers agreed to do without data until BARC was able to supply it. They spent huge sums on the Indian Premier League (IPL) after planning with individual-level TAM data, and then accepted post-buy evaluations based either on the then-available household-level data from BARC; or on the previous season’s TAM data; or did no evaluation at all. That was amazing. Mysteriously, for advertisers who typically ask sharp, searching questions, getting BARC going at that time was important enough for them to risk hundreds of crores of their advertising money, shooting in the dark at a moving target.

In the five years since then, media planners have been complaining about the inadequate granularity of the data and about the interface, compared with what they were accustomed to with TAM. While they have to work with what they have, it is curious that AAAI and ISA – those who use the data and those whose money is spent on that basis – appear to have done little about that.

LACK OF UNDERSTANDING

The present document shows, not for the first time, anxiety to take control of a subject one doesn’t fully understand, or at least has not fully thought through.

Misunderstanding of ‘ratings’: The most fundamental miscomprehension is of the notion of ‘rating’, as if a rating is a critical evaluation. “On the basis of Audience Measurement data, ratings are assigned [emphasis mine] to various programmes on television… Good ratings signal audience approval of a programme while poor ratings signal the opposite,” said the regulator in its Sept 2013 document. That statement, repeated now in April 2020, possibly best explains the constant refrain about transparency. The question really being asked is, “Meters and measurement are all very well, but on what basis do you actually assign the ratings?”

Multiple data collection agencies: “To create credible and accurate collection of data, multiple data collection agencies need to be encouraged,” says the document, and goes on to say that competition would bring in new technologies and methodologies, and generally improve the quality of data. This harks back to the 2013 document.

First, whether you have one agency or two or more, the primary issues and concerns in relation to data collection are to do with data security, confidentiality and panel tampering. Those don’t change. If anything, having multiple agencies makes management more complex and increases the potential for leakage.

Second, the need for consistency in data would require that all data vendors use the same sampling methodology, technology and processes, as designed, stipulated and approved by the ratings publisher, exactly as if there were only one. That, in fact, is what TRAI envisages and recommends three paragraphs later in

the document.

There is a mention of multiple ratings providers, but it is such a passing mention that one is not sure if it is simply a careless use of the term while actually meaning data collection agencies. The question of multiple ratings providers is a whole different discussion, and suffice it to say for the present that it is an obvious but ill-informed and misguided notion.

Increasing the sample size: It is proposed to mandate an increase in the sample size from the current 44,000 people-meters (BAR-o-meters) to 60,000 by the end of 2020, and to 1,00,000 by the end of 2022, and that BARC should be penalised, even to the extent of its licence being cancelled, if it does not meet these targets.

Given that the year is already into its fifth month and no one knows when we will be able to come out of the current lockdown, that obviously is so thoroughly impractical as to be meaningless. More important, it is obvious that the bigger the sample, the higher the cost. The simple question is, who will pay for it? Not the Government, presumably.

Return path data: In a bid to increase the sample base, TRAI proposes mandatory adoption of return path data (RPD) technology, which enables a set top box to report back continuously what is being viewed through it. RPD is an inexpensive and efficient way to collect data from a very large sample. A set top box is of course not a people meter: it can tell you what is on, but not who is watching, i.e., it can provide box-level data, not the individual level data that is crucial for media planning. With that limitation, though, RPD can be a very useful adjunct to people

meter data.

Strangely, though, while recommending that universal adoption of RPD should be mandated, TRAI specifically says that DPOs – cable and DTH operators – should be allowed to negotiate the terms on which they will share the data with the ratings agency! It is distinctly odd that in a document that specifies everything from the shareholding pattern and the composition of the board to the organisation structure to the sample size to how long data must be retained, and a lot else besides, the regulator categorically proposes that DPOs be allowed to extract the price of the data they collect, which the ratings agency is obliged to buy. But this is consistent with TRAI’s past pattern, of pulling its punches when it comes to the distribution trade.

Why TRAI persists in intervening in audience measurement remains a mystery to me. If, as the broadcast regulator, it either believes it must sometimes, or is moved by some disgruntled parties, it must confine itself to the broad policy and directional level, not attempt to micromanage. There are some fundamental issues with BARC, arising from its ownership structure. But if advertisers and their industry body are not fussed about the basis on which they spend thousands of crores of their advertising money (Rs 28,500 crore in 2019), that is no one’s business but theirs – and certainly not the Government’s.

(Chintamani Rao is one of the few people who have seen TV audience measurement in India in all its aspects. He has been a subscriber on both the broadcasting side of the business and on the media agency side, and has served on the industry bodies of both; was one of the founders of the Broadcast Audience Research Council (BARC) and Chairman in its early days, and represented BARC to the government and TRAI. Earlier, he also served on the TAM Transparency Panel, an international group of independent experts, to advise TAM on subscribers’ issues)